IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

2024 ONLINE TAX RETURN eSIGNATURE PROCESS

ALL Files are Encrypted and Password Protected

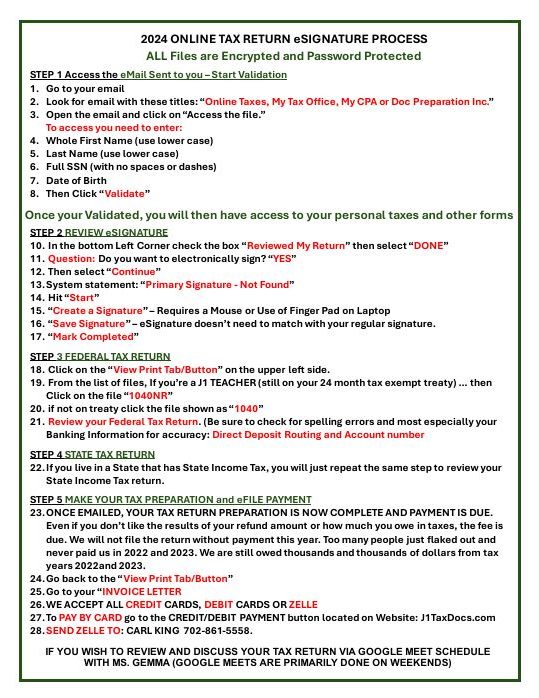

2024 ONLINE TAX RETURN eSIGNATURE PROCESS

ALL Files are Encrypted and Password Protected

STEP 1 Access the eMail Sent to you – Start Validation

1. Go to your email

2. Look for email with these titles: “Online Taxes, My Tax Office, My CPA or Doc Preparation Inc.”

3. Open the email and click on “Access the file.”

To access you need to enter:

4. Whole First Name (use lower case)

5. Last Name (use lower case)

6. Full SSN (with no spaces or dashes)

7. Date of Birth

8. Then Click “Validate” Once your Validated, you will then have access to your personal taxes and other forms

STEP 2 REVIEW eSIGNATURE

10. In the bottom Left Corner check the box “Reviewed My Return” then select “DONE”

11. Question: Do you want to electronically sign? “YES”

12. Then select “Continue”

13.System statement: “Primary Signature - Not Found”

14. Hit “Start”

15. “Create a Signature” – Requires a Mouse or Use of Finger Pad on Laptop

16. “Save Signature”– eSignature doesn’t need to match a regular signature. 17. “Mark Completed”

STEP 3 FEDERAL TAX RETURN

18. Click on the “View Print Tab/Button” on the upper left side.

19. From the list of files, If you’re a J1 TEACHER (still on your 24 month tax exempt treaty) … then Click on the file “1040NR”

20. if not on treaty click the file shown as “1040”

21. Review your Federal Tax Return. (Be sure to check for spelling errors and most especially your Banking Information for accuracy: Direct Deposit Routing and Account number

STEP 4 STATE TAX RETURN

22.If you live in a State that has State Income Tax, you will just repeat the same step to review your State Income Tax return.

STEP 5 MAKE YOUR TAX PREPARATION PAYMENT

23.ONCE EMAILED, YOUR TAX RETURN PREPARATION IS NOW COMPLETE AND PAYMENT IS DUE. Even if you don’t like the results of your refund amount or how much you owe in taxes, the fee is due. We will not file the return without payment this year. Too many people just flaked out and never paid us in 2022 and 2023. We are still owed thousands of dollars from tax years 2022 and 2023.

24.Go back to the “View Print Tab/Button”

25.Go to your “INVOICE LETTER

26.WE ACCEPT ALL CREDIT CARDS, DEBIT CARDS OR ZELLE

27.To PAY BY CARD go to the CREDIT/DEBIT PAYMENT button located on Website: J1TaxDocs.com

28.SEND ZELLE TO: CARL KING 702-861-5558.

IF YOU WISH TO REVIEW AND DISCUSS YOUR TAX RETURN VIA GOOGLE MEET SCHEDULE

WITH MS. GEMMA (GOOGLE MEETS ARE PRIMARILY DONE ON WEEKENDS)

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.